In 2026, UK business owners face one of the most consequential tax changes in recent years. Business Asset Disposal Relief (BADR) a key incentive for entrepreneurs selling their businesses or shares is scheduled to see its capital gains tax (CGT) rate rise from 14% to 18% on 6 April 2026.

This change may seem subtle, but for those who expect a significant gain from selling their business, it’s far from minor. Consider this: on a qualifying gain of £1 million, taxpayers will pay £40,000 more in tax if the relief is claimed after the rate increase instead of at the current rate. That is money that could remain in the hands of retiring owners, reinvested into new ventures, or distributed to stakeholders.

With this impending shift, it is more important than ever for UK business owners to understand BADR, their eligibility, and crucially the correct timing to act.

What Is Business Asset Disposal Relief (BADR)?

Business Asset Disposal Relief is a form of tax relief from capital gains tax, designed specifically for individuals who sell or dispose of their business or certain business assets after years of entrepreneurial effort.

Business Asset Disposal Relief is a form of tax relief from capital gains tax, designed specifically for individuals who sell or dispose of their business or certain business assets after years of entrepreneurial effort.

Originally introduced as Entrepreneurs’ Relief, BADR reduces the tax payable on qualifying gains, making the aftermath of a sale less financially burdensome.

How BADR Works in Practice?

Without BADR, capital gains on business disposals could be taxed at up to 24% for higher‑rate taxpayers, depending on the individual’s overall income and other factors. With BADR, qualifying business owners pay a much lower CGT rate historically as low as 10%, rising to 14%, and soon to 18%.

To simplify:

- CGT without relief: up to 24%

- CGT with BADR (currently): 14%

- CGT with BADR (from April 2026): 18%

The relief applies to gains from disposing of:

- A whole business as a sole trader or partner

- Shares in a personal company

- Business assets after cessation of trade

The objective is to reward long‑term entrepreneurial activity and incentivise continued investment in the UK economy.

Why 2026 Is a Critical Deadline?

The 18% rate hike is legislated to take effect on 6 April 2026, marking the beginning of the UK’s new tax year. This creates a definitive cut‑off point.

The 18% rate hike is legislated to take effect on 6 April 2026, marking the beginning of the UK’s new tax year. This creates a definitive cut‑off point.

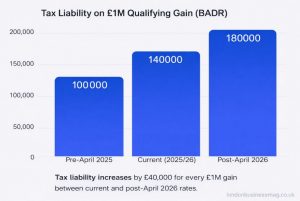

Below is a visual comparison of tax liabilities on a £1 million gain, showing just how much more a business owner might pay if the disposal occurs after this date.

Interpreting the Chart

- Pre‑April 2025 (10% rate): £100,000 tax

- Current (2025/26): 14% rate: £140,000 tax

- Post‑April 2026: 18% rate: £180,000 tax

This progression makes clear why timing matters. A business owner planning to sell in 2026 could see their tax bill jump by £40,000 solely due to the rate change, even if all other factors remain the same.

Who Qualifies for Business Asset Disposal Relief?

BADR isn’t automatic it depends on meeting specific criteria set by HM Revenue & Customs (HMRC). These eligibility conditions are designed to ensure relief is targeted at genuine business owners and active participants, not passive investors.

Primary Eligibility Conditions

To qualify for BADR, an individual must:

- Be a sole trader or business partner, or hold shares in a qualifying personal company.

- Have owned the business or shares for at least two years before the date of disposal.

- If disposing of shares, hold at least 5% of both shares and voting rights in the company.

- Have been an employee or officer of the company for at least two years.

- Sell assets that are used in the business, or sell the entirety of the business.

Example:

A founder who owns 30% of her company, has worked as a director for ten years, and decides to sell her shares in 2026 will likely meet the qualifying conditions provided she holds the required share percentage and voting rights for at least 24 months.

How Much Can You Save with BADR Before the Rate Change?

To understand the practical impact of BADR and the upcoming rate change, we can look at a realistic example.

Scenario: A Business Sold with £1 Million Gain

| Timing of Disposal | BADR Rate | Tax Payable |

| Before April 2025 | 10% | £100,000 |

| Current 2025/26 | 14% | £140,000 |

| After April 2026 | 18% | £180,000 |

Observations:

- Selling now under the current 14% regime saves £40,000 compared with the post‑April 2026 rate.

- Those who sold before April 2025 enjoyed an additional saving of £40,000 beyond the current rate.

- Overall, business owners who time their exit well can significantly reduce their tax burden especially on large gains.

These figures demonstrate the financial importance of strategic planning and early action.

What’s the Best Time to Sell a Business for Tax Efficiency?

Given the April 2026 deadline, business owners considering an exit should begin planning well in advance of that date.

Given the April 2026 deadline, business owners considering an exit should begin planning well in advance of that date.

Actionable Timing Considerations

Start Early: Don’t Wait for Negotiations to Finish Last Minute

Complex transactions can be derailed by delays in due diligence, legal completion, or financing. Starting early increases the likelihood of finalising before the tax year cut‑off.

Completion Date Matters, Not Contract Date

For CGT purposes, what counts is the completion date when ownership changes hands and money transfers not when the contract was signed.

Beware Anti‑Forestalling Rules

HMRC has strict rules to stop individuals from artificially accelerating disposals simply to claim tax benefits. Ensure any actions taken have commercial substance.

Get Professional Guidance

Engaging accountants or tax specialists months before expected disposal gives more flexibility and reduces the risk of missing key deadlines.

How to Claim Business Asset Disposal Relief Correctly?

Claiming BADR is not automatic you must declare it through your tax return.

Step‑by‑Step Process

- Sell the qualifying assets or shares

- Fill in the Capital Gains section in your Self Assessment tax return

- Indicate BADR under “Other reliefs”

- Provide necessary supporting documentation

- Submit the return by 31 January following the tax year of disposal

Tip: It is advisable to keep backed‑up evidence of your eligibility such as share certificates, employment records, and board minutes in case HMRC requests verification.

Alternatives and Related Tax Relief Options

BADR is powerful, but it isn’t the only relief available. Other CGT reliefs can complement or replace BADR in specific circumstances:

Other Relevant Reliefs

- Investors’ Relief: For external investors looking for favourable CGT treatment (also rising to 18%).

- Hold‑Over Relief: Often used when gifting business assets to family members.

- Incorporation Relief: Applies when assets are transferred into a company.

Understanding which relief is most appropriate can make a meaningful difference to your post‑tax outcome.

Conclusion

If a business owner expects a significant gain, the difference between a 14% and 18% CGT rate can be tens of thousands of pounds. Act before 6 April 2026 the effective deadline if you want certainty of benefiting from the current 14% regime.

Whether you’re finalising a deal, restructuring your business, or simply reviewing your long‑term plans, now is the time to talk to your financial and legal advisors about how the BADR changes affect you.

FAQs about Business Asset Disposal Relief

Can I still claim BADR if I’ve sold part of my business?

Yes. BADR applies to partial disposals, provided the portion being sold meets HMRC criteria and all qualifying conditions are satisfied.

Is BADR available for company shares?

Yes. if you hold at least 5% of shares and voting rights, and have been involved in the company’s management for at least two years.

What happens if I sell after the 18% CGT rate takes effect?

Your qualifying gain will be taxed at 18%, which could increase your tax bill significantly compared with selling before 6 April 2026.

Does BADR apply to property used in a business?

Property that is part of the business and meets trading criteria can qualify, but specialised cases (such as mixed‑use properties) may require closer examination.

Can I claim BADR more than once?

Yes, but only up to a lifetime limit of £1 million on qualifying gains.

How long must I own a business to qualify?

You must have owned and been involved in the business (or held the qualifying shares) for at least two years before the date of disposal.

Is BADR automatically applied by HMRC?

No. you must claim it on your Self Assessment return and provide appropriate details