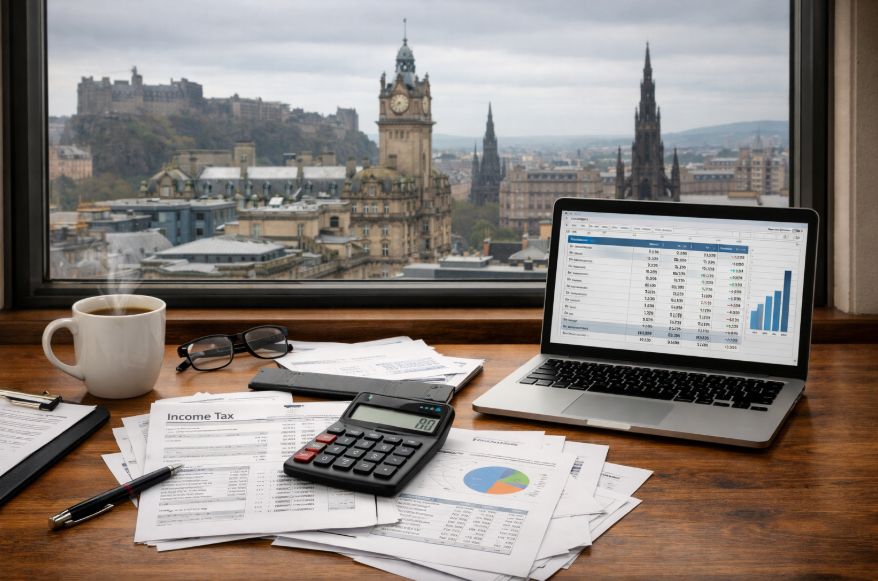

Business Asset Disposal Relief 2026: Act Before the 18% Rate Hike

In 2026, UK business owners face one of the most consequential tax changes in recent years. Business Asset Disposal Relief (BADR) a key incentive for entrepreneurs selling their businesses or shares is scheduled to see its capital gains tax (CGT) rate rise from 14% to 18% on 6 April 2026. This change may seem subtle, […]