📉 NS&I RATE UPDATE

Effective Date: 12 February 2026

National Savings & Investments (NS&I) has confirmed interest rate reductions on two of its most popular easy-access savings accounts. From mid-February, returns on Direct Saver and Income Bonds will fall, affecting millions of UK savers.

Savers holding cash in NS&I accounts may want to review their options as rates across the wider savings market continue to adjust.

In early 2026, millions of UK savers learned that National Savings & Investments (NS&I) will reduce the returns on some of its most popular savings accounts from 12 February 2026. The move follows broader trends in the UK savings market and means that people looking for safe returns on cash will need to rethink where they hold their money. This article explains what’s happening with NS&I’s rates, why it matters and how savers can respond.

What Exactly Is Changing at NS&I?

NS&I, the government‑owned savings provider, announced that two of its easy‑access savings accounts the Direct Saver and Income Bonds will have lower interest rates from 12 February 2026.

NS&I, the government‑owned savings provider, announced that two of its easy‑access savings accounts the Direct Saver and Income Bonds will have lower interest rates from 12 February 2026.

- Direct Saver: The interest rate will reduce to 3.05% gross/AER from its previous level of around 3.30% gross/AER.

- Income Bonds: The rate will fall to 3.01% gross/3.05% AER, down from about 3.26% gross/3.30% AER.

Both accounts allow savers to withdraw funds without penalties, but the reduced returns mean less interest earned on balances from mid‑February onwards. These are the first changes to these variable rate products since March 2025.

What’s Driving NS&I’s Decision to Cut Rates?

Interest rate settings at NS&I tend to reflect broader conditions in the UK savings market. Following a series of cuts to the Bank of England’s base rate, some banks and building societies have already trimmed the rates they pay savers. NS&I’s adjustments bring its variable rates closer in line with this wider environment.

NS&I has dual objectives: it provides savers with secure products and also helps the government attract funds to support public finances. Balancing these aims means adjusting rates when market conditions shift even if those changes are unwelcome for savers.

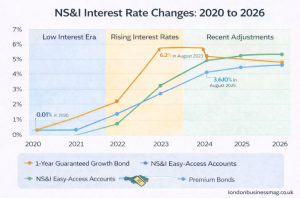

A Timeline of NS&I Interest Rate Changes: 2020 to 2026

NS&I interest rates tend to rise and fall in cycles, closely following changes in inflation and the Bank of England base rate.

NS&I interest rates have moved through dramatic shifts over the past six years, closely tracking changes in the Bank of England base rate and the wider economic environment. During the early 2020s, savers experienced historically low returns, followed by a rapid rise as inflation surged, before rates began easing again in 2026.

NS&I interest rates have moved through dramatic shifts over the past six years, closely tracking changes in the Bank of England base rate and the wider economic environment. During the early 2020s, savers experienced historically low returns, followed by a rapid rise as inflation surged, before rates began easing again in 2026.

2020–2021: The Low Interest Rate Era

During the height of the pandemic and its aftermath, UK interest rates fell to record lows. NS&I Investment Accounts paid as little as 0.01%, while many easy-access savings products averaged around 0.16%. For savers, returns during this period were minimal, with inflation frequently outpacing interest earned.

2022–2023: Rapid Rate Increases

As inflation accelerated, the Bank of England began raising base rates sharply. NS&I responded by increasing returns across its product range. This period marked one of the strongest phases for government-backed savings, with 1-year Guaranteed Growth Bonds reaching a record 6.2% in August 2023. Premium Bonds also became more attractive, with rising prize fund rates improving average returns for holders.

2024–2026: Cooling Inflation and Rate Adjustments

Following the peak in rates, inflation began to ease and monetary policy shifted. NS&I gradually reduced returns on some products, reflecting broader market conditions.

By early 2026, easy-access rates were trimmed, while fixed-term bonds continued to offer competitive returns of up to around 4.07%. Meanwhile, the Premium Bond prize fund rate increased from 1.00% in 2020 to 3.60% by August 2025, highlighting how prize-based products have evolved alongside traditional savings.

Taken together, these trends show that NS&I rates move in cycles rather than straight lines. Understanding this historical context helps explain why the 2026 rate cuts are not unusual and why savers should expect future adjustments as economic conditions continue to change.

How Do Lower Rates Affect Everyday Savers??

For people counting on returns from their cash savings, even a modest drop in interest can have a tangible impact.

Lower annual returns

Money held in Direct Saver or Income Bonds will grow more slowly after the change.

Income impact

For savers drawing interest as part of their regular income for example in retirement the reduction means slightly less monthly or yearly income than before.

Relative appeal

With cut rates at NS&I, some commercial savings accounts may now offer higher returns, making them more attractive if savers are comfortable holding their money outside of government‑backed products.

While NS&I’s products remain secure and accessible, savers focused on maximising returns especially with larger balances may want to explore alternatives.

What Other Savings Rates Look Like in the UK?

Despite rate cuts in many parts of the market, some providers are still offering competitive returns compared with NS&I’s updated variable rates:

| Savings Option | Rate (Approx.) | Access Type | Notes |

|---|---|---|---|

| NS&I Direct Saver | 3.05% gross/AER | Easy access | Lowered from previous level |

| NS&I Income Bonds | 3.05% AER (3.01% gross) | Easy access | Paid monthly |

| Premium Bonds | 3.60% prize fund rate | Instant access | No interest, lottery-style prizes |

| High street easy-access accounts | Up to ~4.5% variable | Easy access | Some require conditions |

| Fixed-term bonds | Around 4.0%+ | Locked for term | Higher returns for fixed terms |

| Cash ISAs | Up to ~4.3% | Easy access or fixed term | Tax-free returns available |

Savers should compare these options carefully, taking into account access needs, tax status and return expectations.

Are NS&I Accounts Still Worth It?

NS&I products continue to have strengths that can make them suitable for many savers:

NS&I products continue to have strengths that can make them suitable for many savers:

- Government backing: Deposits with NS&I are backed 100% by the UK Treasury more extensive protection than the Financial Services Compensation Scheme’s standard £120,000 limit per institution.

- Liquidity: Easy‑access accounts allow savers to withdraw their funds without penalties, providing flexibility.

- Premium Bonds offer a unique choice: instead of interest, savers enter a monthly prize draw with tax‑free winnings.

However, for savers prioritising higher yields, market alternatives particularly fixed‑term bonds and some bank savings accounts may offer stronger returns.

How Savers Can Respond to the Rate Reductions?

Here are practical steps to help manage savings effectively after the NS&I rate changes:

Review savings goals

Consider why you are holding cash is it for emergency funds, near‑term spending or longer‑term goals?

Compare alternatives

Look at current market rates for easy‑access, notice and fixed‑term accounts. Independent comparison sites can help identify products offering better returns.

Use ISA allowances

Cash ISAs offer tax‑free returns, which can boost net earnings, especially for basic and higher rate taxpayers.

Balance security and return

f capital security is paramount, NS&I or Premium Bonds may still fit well. If higher yield is the priority, consider diversifying into other vehicles.

Could There Be More Rate Changes Ahead?

Interest rate movements in 2026 will continue to reflect economic conditions, inflation, and Bank of England policy decisions. If base rates move lower again, more providers including NS&I might adjust their savings products. Savers should stay informed about monetary policy and market trends as the year unfolds.

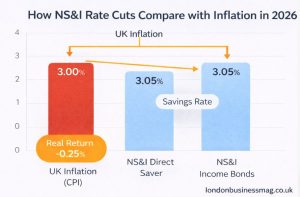

How Do NS&I Rate Cuts Compare with Inflation in 2026?

When assessing the impact of NS&I’s interest rate cuts, it is important to consider how the new savings rates compare with inflation. In 2026, UK inflation is expected to remain around the 2.5%–3.0% range, depending on energy prices, wage growth and wider economic conditions.

When assessing the impact of NS&I’s interest rate cuts, it is important to consider how the new savings rates compare with inflation. In 2026, UK inflation is expected to remain around the 2.5%–3.0% range, depending on energy prices, wage growth and wider economic conditions.

With the Direct Saver and Income Bonds both paying around 3.05% AER after the February rate reduction, savers are only just keeping pace with inflation in nominal terms. Once tax is taken into account for non-ISA accounts, the real return on savings may fall close to zero or even turn slightly negative for some individuals.

This means that although savers may see their balances increase on paper, the purchasing power of that money could stagnate or decline over time. For households relying heavily on cash savings to protect their wealth, this erosion can become significant, particularly if inflation remains elevated for longer than expected.

NS&I products continue to offer security and stability, but the narrowing gap between interest rates and inflation highlights a growing challenge for cautious savers. In a low-growth, moderating-inflation environment, simply holding cash is no longer guaranteed to preserve real value, prompting many savers to reassess how much they keep in easy-access accounts versus longer-term or tax-efficient alternatives.

Who Is Most Affected by the NS&I Interest Rate Cuts?

Although the changes apply to all holders of Direct Saver and Income Bonds, the impact is not the same for everyone.

- Retirees and income-reliant savers: Those using monthly interest payments to supplement pensions may feel the reduction more immediately.

- High-balance savers: Even small percentage drops can translate into noticeable losses in annual interest when large sums are held.

- Risk-averse households: Savers who prefer government-backed products over market alternatives may have fewer comparable options offering similar security.

On the other hand, savers holding funds for short-term needs or emergency buffers may view the reduced rates as an acceptable trade-off for flexibility and safety.

Understanding where you fall within these groups can help determine whether staying with NS&I remains the right choice or whether adjusting your savings strategy makes sense.

Conclusion

The recent NS&I interest rate cuts are part of a wider shift in the UK savings industry. While these cuts reduce returns on familiar government‑backed accounts, there are still ways for savers to optimise their cash holdings. By aligning savings choices with personal goals, comparing alternatives and using tools like ISAs and fixed‑term products, individuals can manage their savings effectively even in a changing rate landscape.

FAQs About NS&I Interest Rate Changes

Will Premium Bonds change too?

There has been no announcement about changing the Premium Bonds prize fund rate at this time, but analysts note it could be reassessed if market conditions evolve.

Why are savings rates generally falling?

Many savings providers adjust rates in response to shifts in the Bank of England base rate and wider economic trends.

Is NS&I still a safe place to save?

Yes, being backed by HM Treasury means deposits are secure in full, beyond typical FSCS limits.

Should savers move their money now?

This depends on your priorities. Those seeking higher returns might explore other accounts, while savers prioritising ease and security may stay put.

What is the difference between gross and AER?

‘Gross’ is the basic interest rate before tax. ‘AER’ shows the equivalent annual return if interest were compounded — useful for comparing products.

Are there tax‑free options to consider?

Yes, cash ISAs shelter interest from tax, potentially increasing net returns.

How often should I check savings rates?

It’s wise to review savings options whenever you hear of base rate changes or regularly (e.g., quarterly) to ensure you’re getting good value.